inheritance tax changes budget 2021

Whats NewNew Jersey Estate Tax Changes Accessed Nov. The government has published the personal allowance for 202122 on its website and as such has confirmed that it will increase by the increase in the Consumer Prices Index for September 2020 which stood at 05.

How Is Tax Liability Calculated Common Tax Questions Answered

15 lakhs tax saving mutual funds ELSS PPF NPS 80CCD 80D.

. An inheritance tax is a state tax that you pay when you receive money or property from the estate of a deceased person. From 1780 Legacy Duty an. Buying and running a car.

Continue reading Personal Allowance. The personal exemption for tax year 2021 remains at 0 as it was for 2020. The individuals are required to provide information related to income received form various sources such as salary rent etc.

Tax Saving - How to Save Income Tax For FY 2021-22. For tax year 2021 the top tax rate remains 37 for individual single taxpayers with incomes greater than 523600 628300 for married couples filing jointly. The income tax return forms notified by the CBDT for FY 2021-22 have been kept unchanged.

Make changes to your 2021 tax return online for up to 3 years after it has been filed and accepted by the IRS through 10312024. North Carolina also repealed its estate tax on January 1 2010 but it reinstated it a year later. From 1694 Probate Duty introduced as a stamp duty on wills entered in probate in 1694 applying to personalty.

In the ITR forms as applicable for the FY ended on March 31 2022. How it works what you might get National Insurance. Taking your pension.

75000 and section 24 claims deduction up to Rs. Put simply if you have a pension fund and you nominate your heirs to get the money if you die before you use it they will receive the whole amount tax-free. The income tax department has notified the income tax return ITR forms for FY 2021-22 or AY 2022-23.

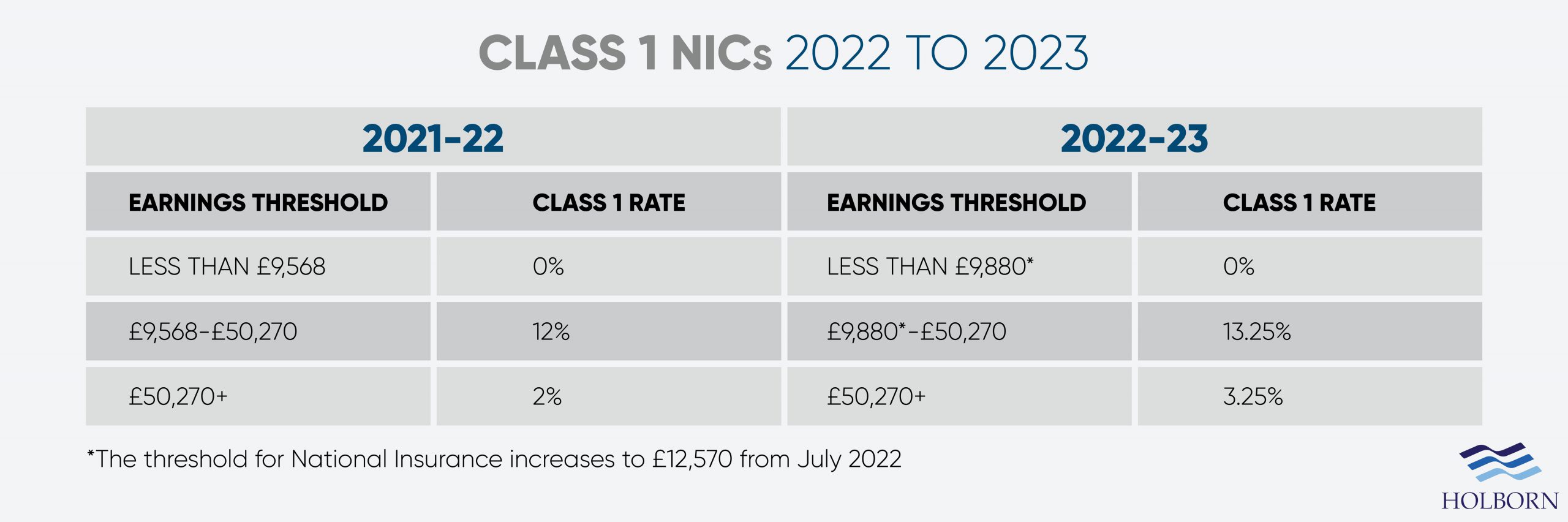

The personal allowance is the amount of money that each person can earn before paying tax on their earnings. Terms and conditions may vary and are subject to change without notice. If you would like to view the 202223 tax brackets you can view these here This year many rates remained unchanged Inheritance Tax and Capital Gains Tax being two such rates.

New Jersey phased out its estate tax in 2018. An assessment year AY is the year followed by the financial year and AY is the year in which income earned by an individual during the FY is reported to the government and taxes are paid accordingly. Complaints financial help when retired changes to schemes.

How to budget find the best deals and switch to save money. 40 2022 1206 million. Make changes to your 2021 tax return online for up to 3 years after it has been filed and accepted by the IRS through 10312024.

Both tax and exemptions are based on the relationship of the beneficiary to the decedent. It was announced in the Finance Bill 2021 that inheritance tax nil rate bands will remain at existing. INHERITANCE TAX IHT is levied on the value of a persons estate on the date of death and is charged at all 40 percent of all assets over.

2013 under Ohio budget laws. Terms and conditions may vary and are subject to change without notice. For example the Kentucky inheritance tax is a tax on the right to receive property from a decedents estate.

Tax brackets were once again updated following this years Budget on 6 March 2021. Prior to the introduction of Estate Duty by the Finance Act 1894 there was a complex system of different taxes relating to the inheritance of property that applied to either realty land or personalty other personal property. Get a list of states without an estate or inheritance tax.

Tax Saving is the best options for investment like Section 80C offers Rs. Raising the money to pay the inheritance tax bill may mean cashing in any savings accounts held by the deceased and potentially selling some of the assets in the estate 14102021 242. Taxes are paid not by the estate of the deceased but by the inheritors of the estate.

With the approval of the Law 112020 of 30 December on the General State Budget for 2021 the second section of the sole article of Royal Decree-Law 132011 of 16 September which re-established the Wealth Tax on a temporary basis is repealed and the indefinite nature of the wealth tax is re-established although a different measure may. 2 lakh for the interest on the home loan. Section 80D also offers for investments Rs.

For TurboTax Live Full Service your tax expert will amend your 2021 tax return for you through 11302022. This elimination of the personal exemption was a provision in the Tax Cuts and Jobs Act. Major changes in the rules on the inheritance of pensions came into force on 6 April 2015.

Liberals May Be More Open To Ndp Tax Proposals In New Parliament Experts Say Advisor S Edge

Changes To Uk Tax In 2022 Holborn Assets

The Proposed Changes To Cgt And Inheritance Tax For 2021 2022 Bph

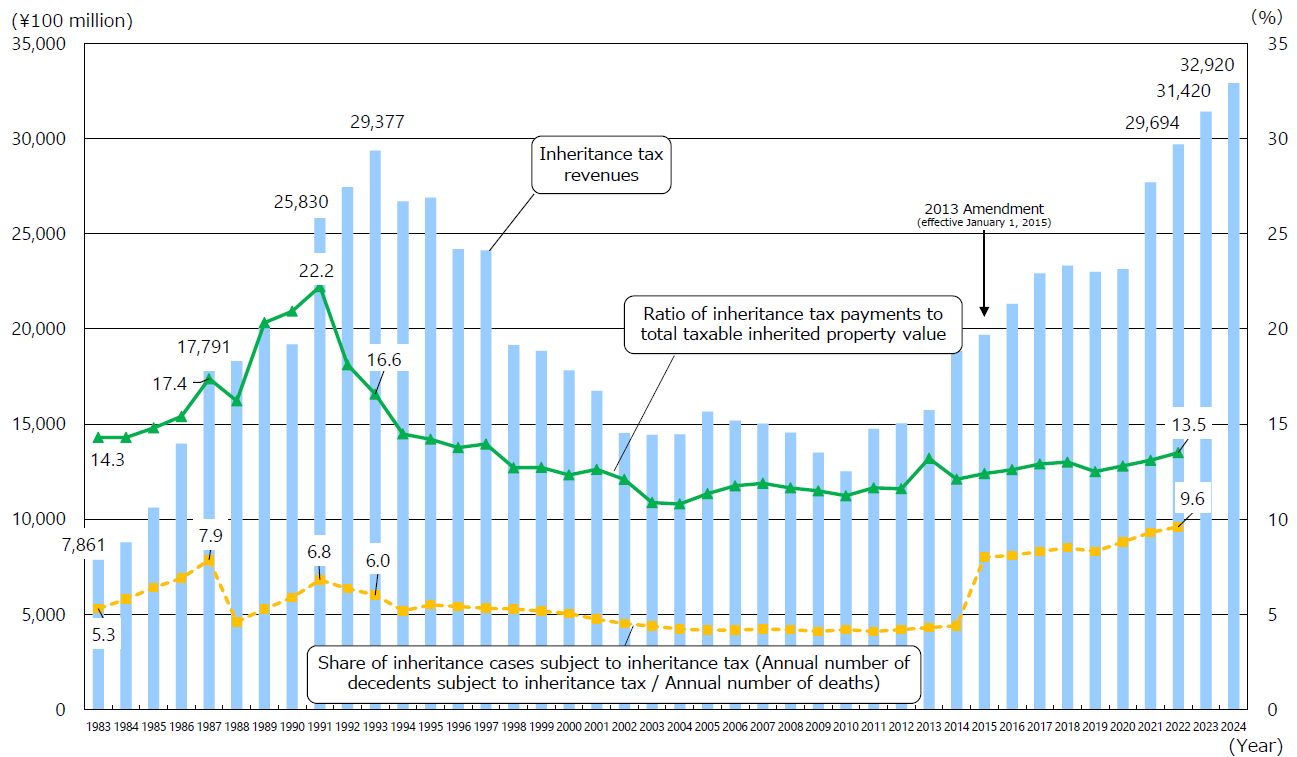

Materials On Asset Taxation Ministry Of Finance

What Are The Consequences Of The New Us International Tax System Tax Policy Center

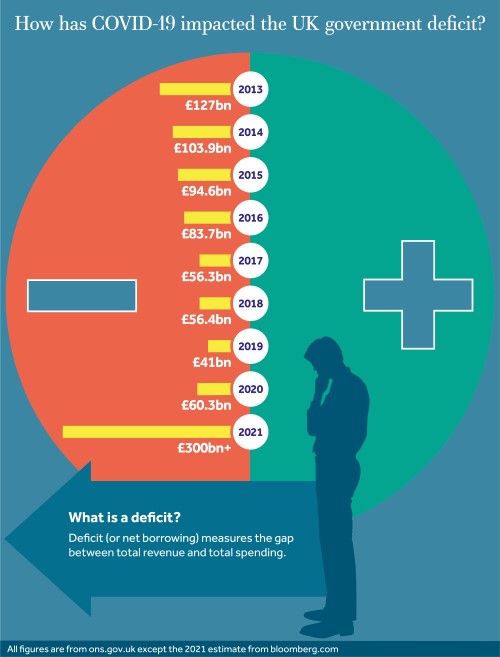

Post Covid 19 Tax Planning Be Prepared For Tax Rises Cgwm Uk

Annex 6 Tax Measures Supplementary Information Budget 2021

How Do Taxes Affect The Economy In The Short Run Tax Policy Center

Budget Summary 2021 Key Points You Need To Know

Potential Impact Of Estate Tax Changes On Illinois Grain Farms Farmdoc Daily

Inheritance Tax Budget 2021 Nil Rate Band

Annex 6 Tax Measures Supplementary Information Budget 2021

What Is The Tax Expenditure Budget Tax Policy Center

The Curious Task Of Redistributive Taxes Inheritance And Corporate Taxes Berkeley Political Review

Tax Highlights From Budget 2021 Advisor S Edge

What Is The Stepped Up Basis And Why Does The Biden Administration Want To Eliminate It

What Are Marriage Penalties And Bonuses Tax Policy Center

How Do State Estate And Inheritance Taxes Work Tax Policy Center